SubLegder Accounting in R12

SLA Part -1

In these article, we will explore the very basics of SLA and why it exists.

Firstly, what exactly does SLA do?

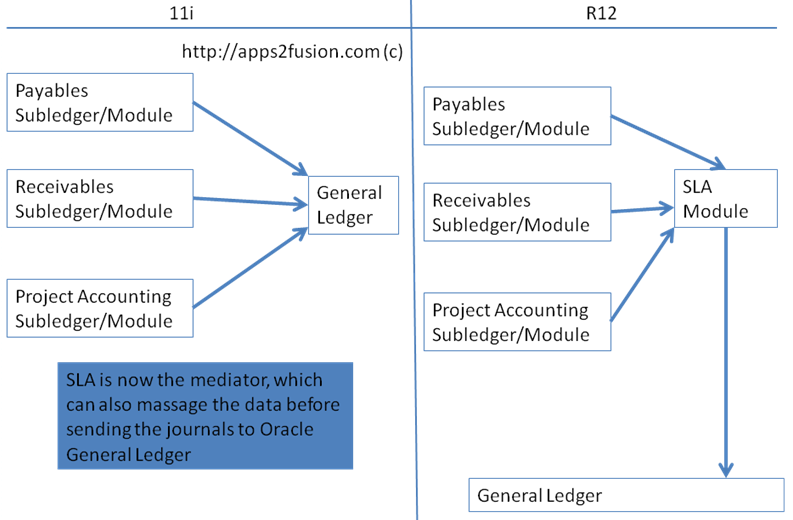

SLA is a module which now sits between the SubLedgers like AP/AR etc and the General Ledger. Have a look at this diagram below. As you will notice, SLA can act as a mediator between the subledgers and Oracle General Ledger.

Before we progress, some terminologies of R12 must be revisited. In 11i we had set of books, and in R12 we call them Ledgers. Likewise in R12 we also have secondary ledgers and reporting ledgers. Hence from 11i perspective think of Ledger as Set of Books. As for Subledger, a Subledger is nothing but a module like AP/AR/PO/Inventory etc.

In the diagram below, the second scenario is explained whereby let's say that payables module generates a charge account segment combination for an invoice distribution line as A.B.C.D. In such case, if SLA module is not customized, then the very same A.B.C.D combination will be passed to Oracle General Ledger via the SLA. And before you wonder... Yes, SLA module has its own set of tables to capture these accounting entries.

Before we progress, some terminologies of R12 must be revisited. In 11i we had set of books, and in R12 we call them Ledgers. Likewise in R12 we also have secondary ledgers and reporting ledgers. Hence from 11i perspective think of Ledger as Set of Books. As for Subledger, a Subledger is nothing but a module like AP/AR/PO/Inventory etc.

In the diagram below, the second scenario is explained whereby let's say that payables module generates a charge account segment combination for an invoice distribution line as A.B.C.D. In such case, if SLA module is not customized, then the very same A.B.C.D combination will be passed to Oracle General Ledger via the SLA. And before you wonder... Yes, SLA module has its own set of tables to capture these accounting entries.

Please see the image below.

In the image above, SLA passes to GL whatever value is fed by the Subledger, in this case A.B.C.D

There are cases where SLA module can alter or massage the CCID or code combination that is generated in Subledger before transferring the same to Oracle General Leger. This scenario is explained whereby let's say that payables module generates a charge account segment combination for an invoice distribution line as A.B.C.D. In such case, if SLA module is customized, then the A.B.C.D code combination of Payables can be passed to Oracle General Ledger via the SLA as A.B1.C1.D instead.

The most important application however of the SLA is its ability to create shadow journals that contain different values or differing credit/debit entries for the transactions. This is the main reason why SLA module was invented/designed. Let us take an example. For company "Apps2Fusion UK", it might have operations in France, which is "Apps2Fusion France". With UK being the parent company, the French company has to do accounting journals in formats that can be reported as per French legislation and also as per UK legislation. For example, in France an inventory item is accounted as expense, whereas in UK the inventory item is accounted as an asset. In the example below, A.B.C.D is never passed to the GL. Instead to GL A.B1.C1.D is passed to the Primary Ledger FRANCE and A2.B2.C.D is passed to the Secondary Ledger UK. The picture below shows the role that SLA plays in such scenario.

Therefore in this article you have learnt the different usages of Subledger accounting

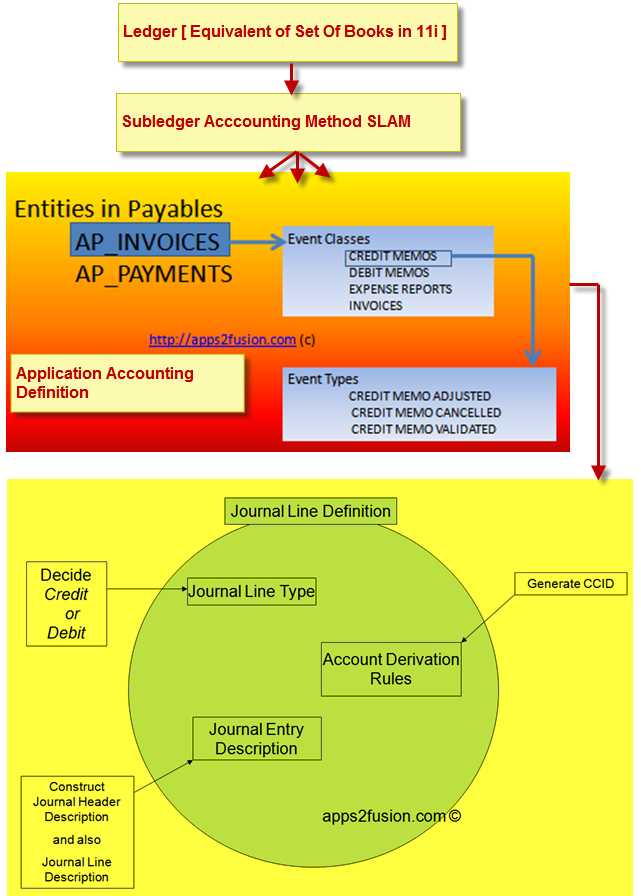

SLA PART 2 : Entities - Event Classes - Event Types

In this article you understand some of the basics fabrics/terminology used in SLA, i.e. Entities, Event Classes and Event Types. It is important for you to understand the variables within SLA engine which influence whether an accounting entry needs to be generated for a specific event within subledger like Payables or Receivables. For example in Procurement, there may be a need to generate accounting whenever a Purchase Order is encumbered. In case of SLA, the activity of "Encumbrance" against a Purchase Order is known as Event Type.

Likewise when a Payables Invoice is Validated, then you may want to create an accounting entry. In this case the "Invoice Validation" is an "Event Type". And your accounting rules for Invoice Validation will be attached against this specific "Event Type".

For Payables, an INVOICE transaction and a PAYMENT transactions are known as Entities within SLA.

Entities can be subdivided into various "Event Classes", for example Credit Memo, Debit Memo, Expense Reports, Invoices etc.

Further to this, against the Event classes we define Event Types, for example, whenever your Invoice is validated or cancelled or adjusted, you may want some specific accounts in the General Ledger to be impacted. Event types are therefore the types/list of events against transactions which you wish to account for in General Ledger.

This is explained in the diagram below.

Likewise when a Payables Invoice is Validated, then you may want to create an accounting entry. In this case the "Invoice Validation" is an "Event Type". And your accounting rules for Invoice Validation will be attached against this specific "Event Type".

For Payables, an INVOICE transaction and a PAYMENT transactions are known as Entities within SLA.

Entities can be subdivided into various "Event Classes", for example Credit Memo, Debit Memo, Expense Reports, Invoices etc.

Further to this, against the Event classes we define Event Types, for example, whenever your Invoice is validated or cancelled or adjusted, you may want some specific accounts in the General Ledger to be impacted. Event types are therefore the types/list of events against transactions which you wish to account for in General Ledger.

This is explained in the diagram below.

Each entity is identified by unique identifier or primary key from the underlying tables.

SLA PART 3 : (Journal Line Definition) :

The Journal Line Definition "defines" how the entire journal is built. To create any journal, one of the key things is to get the CCID or the code combination of segments. SLA needs to know where this CCID will be coming from. You also need to know whether this CCID will be debit or this CCID will go into credit. Therefore you not just require the CCID, but you also need to decide whether a specific CCID will be debited or credited. In SLA, the "Journal Line Type" will specify whether the accounting entry is credit or debit. Also, you can then "attach something called an ADR to this Journal Line Type". The ADR returns the final code combination. Therefore Journal Line type will leverage the JLT+ADR to know which CCID is crediting and which CCID is debiting in the journal.

For each and every application there is a combination of event class and event type. Depending upon the combination of event class and event type the accounting gets triggered. The standard SLA out of the box from Oracle meets your requirement by 90%. For example you can fetch the standard accounting from payables or receivables options. However where these standard seeded accounting do not suffice, you can go and modify SLA to meet your business needs.

There is something called as Journal Entry Description. When a transaction is transferred as a journal, then every journal has credit/debit and description. The journal has description at header and also at line level. The JED allows you to generate the description of the Journal at both header and line level. For example you may want Customer Name or Customer Number in the journal description for a journal that is initiated from Oracle Receivables module. Using JED in SLA you can build header or line level descriptions.

The image below describes the end result journal that is produced by SLA

In JLT Journal Line Type, you can specify whether the entry is for credit or debit side. The Journal Line Type also provides options to do accounting for Gain/Loss of Foreign currency transactions. Further to that you can specify if SLA should merge the journal lines that have same CCID.

ADR - We specify how the account combination must be generated. We tell the system how we want the CCID should be built and transferred to the general ledger. You can either transfer the standard account as calculated within Subledger(AP or AR or PA etc) or the account generated from Subledger can be modified or replaced via ADR configuration within SLA.

Further to this, when defining ADR, you can specify the conditions under which a specific segment or CCID is returned. These conditions are like IF Conditions.

It is good to remember that the "Journal Line Definition=JED+JLT+ADR"

This is visible from the screenshot as shown below

You will notice that two "Journal Line Types" have been attached to this Journal Line Definition. The first journal line type assignment creates a credit line in the journal and the second journal line type assignment creates a debit line in the journal.

By now you would have understood the significance of Journal Line Definition. However you might be wondering how this Journal Line Definition gets associated with a Subledger transaction. For example, how does Oracle E-Business Suite decide which specific Journal Line Definition should be used when a specific event takes place against an invoice in Oracle Payables. In other words, how will SLA decide how the Journal will be constructed when an invoice is validated within Payables. We will learn this via AAD in next part of the article using Application Accounting Definitions.

SLA PART 4 : (Application Accounting Definitions)

In the SLA Part 2 article you Entities, Event Class and Event Types. In the SLA Part 3 you learnt the high level basics of Journal Line Definitions.

In this Part 4, you will see how the "Journal that gets constructed using Journal Line Definition" is associated with an underlying transaction in the respective module.

As seen in the image above, the Application Accounting Definitions [AAD] is attached to one or more Journal Line definition [JLD].

Effectively it means that AAD = JLD for an Event Class+ Event Type combination = ADR+JED+JLT for an Event Class+ Event Type combination

As a thumb rule, you must remember that each Application Accounting Definition [AAD] belongs to a module. Therefore if you have one Ledger implemented [ 11i Set Of Books] and two modules implemented like AP and AR, then you will have 2 AAD's defined, i.e. one for Payables and another for Receivables.

In the above picture only one Event Class of Invoice is used in AAD. However in reality you will have more than one event classes like Invoices, Payments etc associated with a AAD for Payables module.

Seeded Application Accounting Definitions are provided for each module out of the box by Oracle. However if the existing definitions do not meet your business requirements, then you can copy the existing AAD's to a custom AAD, and then make alterations to the custom AAD, which means creating custom JLT, custom JED and custom ADR as appropriate. It is important to remember that you must create a custom copy of an existing SLA component before making modifications.

In the next article you will see Subledger Accounting Method.

SLA PART 5 : (SubLedger Accounting Methods)

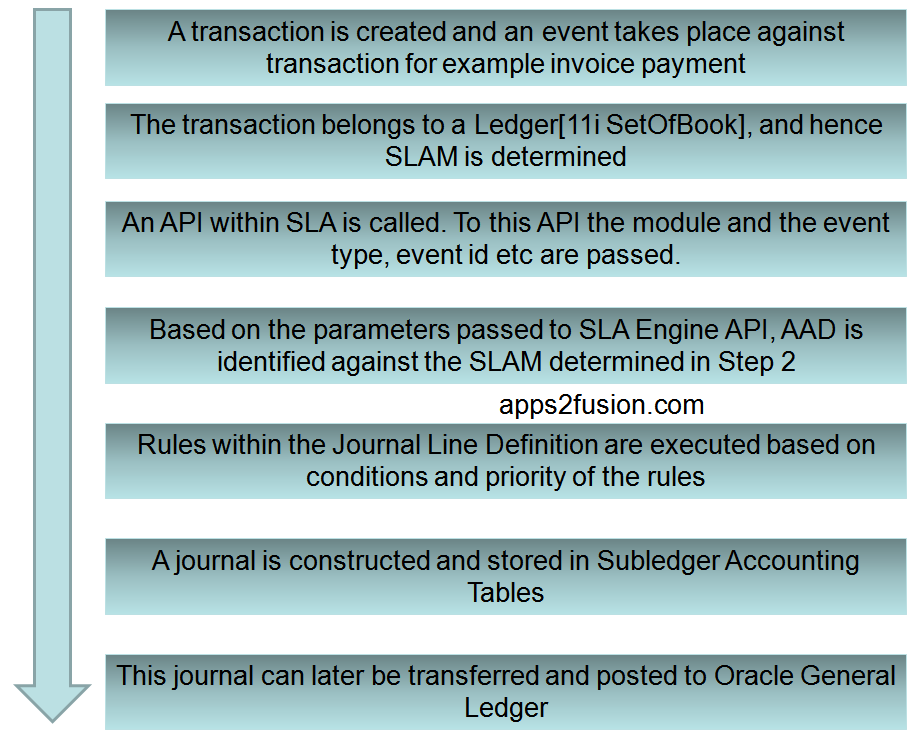

As we have seen in the Part 4 of SLA, the Application Accounting definition is used to decide two things

a. When a specific event within Subledger example Payables or Receivables becomes eligible for Accounting

b. How the journal is constructed.

However, each Primary Ledger[ 11i equivalent of primary set of book] and also each secondary ledger should be able to generate Journals as per their respective legislator requirements for all the modules implemented. This is where "Subledger Accounting Method" [SLAM] comes into the play. If you recollect from previous article, Application Accounting Definition is connected to only one module like Payables or Receivables etc. However a Ledger[11i SOB equivalent] needs accounting entries to be processed across many modules. Hence SLAM provides an umbrella to join accounting entries from various modules so that they can be channelled through to Oracle General Ledger. In other words a SLAM is a collection of accounting definitions for various modules in Oracle Apps. A SLAM is then attached to the Ledger[11i equivalent of Set Of Books].

Therefore the flow of accounting entries appears as shown below

The flow represented in simple equation appears as below

Ledger Defined in GL-->SLAM-->AAD--> [Event Class and Event Type]-->Liability Lines-->[JED+JLT+ADR]

Ledger Defined in GL-->SLAM-->AAD--> [Event Class and Event Type]-->Expense Lines-->[JED+JLT+ADR]

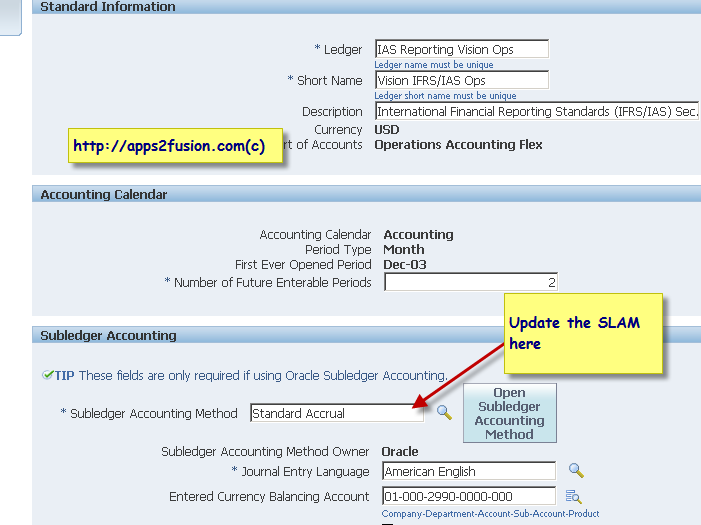

In order to assign the SLAM to a ledger, go to the General Ledger Super User responsibility and click on menu as shown below.

Click on update against the ledger

Attach the SLAM to this ledger

You can also modify the SLA accounting options using the two screenshots as shown below

a. When a specific event within Subledger example Payables or Receivables becomes eligible for Accounting

b. How the journal is constructed.

However, each Primary Ledger[ 11i equivalent of primary set of book] and also each secondary ledger should be able to generate Journals as per their respective legislator requirements for all the modules implemented. This is where "Subledger Accounting Method" [SLAM] comes into the play. If you recollect from previous article, Application Accounting Definition is connected to only one module like Payables or Receivables etc. However a Ledger[11i SOB equivalent] needs accounting entries to be processed across many modules. Hence SLAM provides an umbrella to join accounting entries from various modules so that they can be channelled through to Oracle General Ledger. In other words a SLAM is a collection of accounting definitions for various modules in Oracle Apps. A SLAM is then attached to the Ledger[11i equivalent of Set Of Books].

Therefore the flow of accounting entries appears as shown below

The flow represented in simple equation appears as below

Ledger Defined in GL-->SLAM-->AAD--> [Event Class and Event Type]-->Liability Lines-->[JED+JLT+ADR]

Ledger Defined in GL-->SLAM-->AAD--> [Event Class and Event Type]-->Expense Lines-->[JED+JLT+ADR]

In order to assign the SLAM to a ledger, go to the General Ledger Super User responsibility and click on menu as shown below.

Click on update against the ledger

Attach the SLAM to this ledger

You can also modify the SLA accounting options using the two screenshots as shown below

SLA PART 6 : (Overall SLA Diagram)

The overall flow of the SLA can therefore be depicted as shown in image below.

Overall, when you create new definitions in SLA, you can follow the bottom up model.

Overall, when you create new definitions in SLA, you can follow the bottom up model.

The parallel flow on top, as shown in image below is to ensure both a Credit and Debit line gets created for a Journal.

SLA PART 7 : (Creating Journal Line Definition) :

In this article we will create a Journal Line Definition. You will basically apply the steps learnt thus far into practical implementation.

However to create a Journal Line Definition, we need to create the following

1. Journal Entry Description for journal line description2. Journal Line Type to mainly define credit or debit3. Account Derivation Rules for CCID used in journal line

Therefore typically, two set of JED,JLT and ADR’s are required, with one set each for Credit line, and the other set for the debit line.

In this article, we will create these three components.

Go to a subledger like Payables and within the SLA menu as shown below, you can open the Journal Enty Description screen. Click on New to create a new JED.

However to create a Journal Line Definition, we need to create the following

1. Journal Entry Description for journal line description2. Journal Line Type to mainly define credit or debit3. Account Derivation Rules for CCID used in journal line

Therefore typically, two set of JED,JLT and ADR’s are required, with one set each for Credit line, and the other set for the debit line.

In this article, we will create these three components.

Go to a subledger like Payables and within the SLA menu as shown below, you can open the Journal Enty Description screen. Click on New to create a new JED.

Create a new Journal Entry Description named ANIL_JED. We will use this for generating the Journal Line Description for both the credit and the debit lines.

The journal line description can be constructed by clicking on Details button. The description of the journal line can be a static text or dynamic text based on database sources within SLA or the combination of the two.

Here we are using the Supplier Name to construct the journal line description.

In addition to the dynamic journal line text, SLA allows you to put conditions.

For example

IF CONDITION1=TRUE, then Journal Line Description should be abcd

ELSE IF CONDITION2=TRUE, then Journal Line Description should be defg

Click on condition button to define the condition

After defining the Journal Entry description, now we can create Journal Line Type named ANIL_JLT_CREDIT for the credit line of the journal.

Specify the Transfer to GL in Summary or Detail mode. Also specify Merge, as explain in image below

Use the Payables setup option as source to build condition for JLT

In this example, we want to build a condition for “Journal Line Type” eligibility depending upon whether in the Payables Options Screen has Automatic Offset Method is set to None or Balancing or Account. In the above condition, we have placed an OR condition.

You can for example also build a condition based on Invoice Distribution type as shown below.

Next we need to define the Account Derivation Rule

Here we are creating an account derivation rule for the credit line.

An ADR can either return a full CCID or a specific segment. The values can be sourced either statically or from existing seeded dynamic sources in SLA. These seeded sources are mapped to database tables.

We are stating that this specific ADR named ANIL_LIABILITY_ADR will return a constant value in company segment

In the above image you will see that the value for Company segment can be derived from the corresponding value set.

As below, it is also possible for the specific ADR to return a full segment combination. In fact you can specify conditions within an ADR. When CONDITION1=TRUE then segment combonation a.b.c.d is returned or when CONDITION2=TRUE then d.e.f.g combination is returned for your account.

For the debit side, we are saying that the Account segment must always be 7450

The conditions can be defined. But conditions as evaluated as per the priority.

Finally we create a Journal Line Definition.

Here everything hangs together, JLTJLD,ADR=Journal Line Defnition

As shown below, we are saying that the CCID for the Credit Line of the journal will be calculated from ANIL_LIABILITY_ADR

And the CCID for the debit line will be calculated by the CCID value in Invoice Distribution line, with the specific segment from Account segment being replaced as per ANIL_EXPENSE_ADR.

For example, if the CCID in AP_INVOICE_DISTRIBUTION equates A.B.C.D.E.F then your journal line debit entry will be A.B.7450.D.E.F

SLA PART 8 : (Creating Application Accounting Definition AAD)

In the previous part of this SLA article, you have learnt creation of the Journal Line Definition. Now it is time to create AAD, which is "Application Accounting Definition".

The purpose of AAD in SLA is to dictate which "Journal Line Definition" must be used when a specific event takes place against a specific type of transaction in a specific module like Payables or Receivables. If you recollect, the "Journal Line Definition" definition creates a Credit Line and the Debit Line of a Journal.

Oracle ships out of the box an AAD for every simply module/application that uses SLA.

Hence for each application like AP,AR,PA,PO etc there will exist an existing AAD in the Subledger Modules. However, for this example we will create a new AAD for Payables.

In the previous article you created a Journal Line Definition that is responsible for constructing a Journal. However, in AAD screen you will specify when the Journal Line Definition will be used. In this case, as per the image below, we are stating that journal line definition ANIL_JLD should be used for creating journal whenever any event occurs against an Invoice in Payables.

You can also click on "Header Assignment" button in AAD to attached "Journal Entry Description" [JED] which dictates how the Journal Header description will be constructed. If you recollect, in Journal Entry Description, we concatenate static text and dynamic content from SLA Sources[mapped to DB columns or pl/sql functions] so as to construct a description for Journal Line or Journal header.

In this article we have seen that AAD is created for each module. However, in any implementation there is a need to perform accounting for all the modules. "APPS2FUSION UK" might be running Payables and Receivables and also Project Accounting. Hence we need to create a SLAM-Subledger Accounting Method.

Using AAD we specify the Journal creation rules per module. In SLAM we specify how the Journals must be built for the entire organization "APPS2FUSION UK" across Payables and Receivables and Project Accounting. The company "APPS2FUSION UK" will have a legal entity in UK, and hence the SLAM will be attached to the UK Legal Entity.

The purpose of AAD in SLA is to dictate which "Journal Line Definition" must be used when a specific event takes place against a specific type of transaction in a specific module like Payables or Receivables. If you recollect, the "Journal Line Definition" definition creates a Credit Line and the Debit Line of a Journal.

Oracle ships out of the box an AAD for every simply module/application that uses SLA.

Hence for each application like AP,AR,PA,PO etc there will exist an existing AAD in the Subledger Modules. However, for this example we will create a new AAD for Payables.

In the previous article you created a Journal Line Definition that is responsible for constructing a Journal. However, in AAD screen you will specify when the Journal Line Definition will be used. In this case, as per the image below, we are stating that journal line definition ANIL_JLD should be used for creating journal whenever any event occurs against an Invoice in Payables.

You can also click on "Header Assignment" button in AAD to attached "Journal Entry Description" [JED] which dictates how the Journal Header description will be constructed. If you recollect, in Journal Entry Description, we concatenate static text and dynamic content from SLA Sources[mapped to DB columns or pl/sql functions] so as to construct a description for Journal Line or Journal header.

In this article we have seen that AAD is created for each module. However, in any implementation there is a need to perform accounting for all the modules. "APPS2FUSION UK" might be running Payables and Receivables and also Project Accounting. Hence we need to create a SLAM-Subledger Accounting Method.

Using AAD we specify the Journal creation rules per module. In SLAM we specify how the Journals must be built for the entire organization "APPS2FUSION UK" across Payables and Receivables and Project Accounting. The company "APPS2FUSION UK" will have a legal entity in UK, and hence the SLAM will be attached to the UK Legal Entity.

SLA PART 9 : Create SLAM(Sub Ledger Accounting Method)

In previous article we have seen that in SLA, the "Application Accounting Definition" is created for each module in EBusiness Suite. However, in any implementation there is a need to perform accounting across various different modules. For example, a company named "APPS2FUSION UK" might be running Payables and Receivables and also Project Accounting. Hence we need to create a SLAM [Subledger Accounting Method] that will take care of generating the Accounting journal lines for each of the module. Hence a SLAM is nothing but a grouping of all the AAD's possibly for a given chart of account.

Using AAD we specify the Journal creation rules per module. In SLAM we specify the applications/modules for which the Journals must be built for the entire organization such as "APPS2FUSION UK" across Payables and Receivables and Project Accounting. The decision of whether the journal must be created is delegated to the AAD. As for how the journal is constructed and how the accounts are derived is delegated to the Journal Line Definition.

The company such as "APPS2FUSION UK" will have a legal entity in UK, and hence the SLAM will be attached to the UK Legal Entity.

In the image below we are creating a SLAM named ANIL_SLAM, and attaching the AAD named ANIL_PAYABLES. This is a simplistic example, because in reality you will have the AAD's of other applications like Receivables , Project Accounting, Fixed Assets etc attached to the SLAM as well.

In the above image, click on Accounting Setups, and here you can attach the SLAM to a Ledger. To remind you, in R12, the Ledger is equivalent of set of books in 11i.

SLA PART 10 : (Testing and Explanation of SLA Concept)

In the SLA articles Part 1 to Part 6, we understood the basic concepts of Subledger Accounting.

In the SLA articles Part 7 to Part 9, we configured SLA for Payables as an example.

In this article, we will test the configuration to see the results of the configuration performed in Part 7 to Part 9 of the SLA articles. We will also explain the results of the test.

Our SLA setup was done for Payables, hence we will create an Invoice in Payables and check the accounting entries to reconcile those against our SLA setup.

If you recollect, we created an AAD named ANIL_PAYBLES which is attached to Oracle Payables module. This AAD will invoke JLD named ANIL_JLD to build the journal lines when an event takes place against the Payables invoice.

In the image below we are creating an Invoice from Payables responsibility and ensuring its invoice line distribution account is 01-110-6100-0000-000.

Next we click on Actions button and validate the invoice and create accounting entries.

Now check the accounting generated by clicking on menu title Reports||View Accounting as shown in the image below.

You will notice that the Debit entry of 1000 is charged to 01-110-7450-0000-000 instead of being charged to 01-110-6100-0000-000 in the Invoice Distribution Line of Payables. Please note that the third segments value of 6100 from Invoice Distribution has been replaced by 7450 from ADR named ANIL_EXPENSE_ADR as shown below.

The complete logic is described after this image.

Now, let us revisit how the credit line in the journal has been built. Typically Code Combination for the credit/liability accounting entry of the invoice line is picked from Payables Options setup of the operating unit. However in this case, in SLA we have hard coded the credit account to be 01.000.2220.0000.000. This was done by defining ANIL_LIABILIY_ADR as shown below. In this case the ADR returns the complete CCID because the Output Type radio button is set to Flexfield.

Hence, the SLA has generated the same Credit entry CCID for the invoice, as shown in image below

Needless to say that the ANIL_LIABILITY_ADR was attached to the Journal Line Type=ANIL_JLT_CREDIT.

In the SLA articles Part 7 to Part 9, we configured SLA for Payables as an example.

In this article, we will test the configuration to see the results of the configuration performed in Part 7 to Part 9 of the SLA articles. We will also explain the results of the test.

Our SLA setup was done for Payables, hence we will create an Invoice in Payables and check the accounting entries to reconcile those against our SLA setup.

If you recollect, we created an AAD named ANIL_PAYBLES which is attached to Oracle Payables module. This AAD will invoke JLD named ANIL_JLD to build the journal lines when an event takes place against the Payables invoice.

In the image below we are creating an Invoice from Payables responsibility and ensuring its invoice line distribution account is 01-110-6100-0000-000.

Next we click on Actions button and validate the invoice and create accounting entries.

Now check the accounting generated by clicking on menu title Reports||View Accounting as shown in the image below.

You will notice that the Debit entry of 1000 is charged to 01-110-7450-0000-000 instead of being charged to 01-110-6100-0000-000 in the Invoice Distribution Line of Payables. Please note that the third segments value of 6100 from Invoice Distribution has been replaced by 7450 from ADR named ANIL_EXPENSE_ADR as shown below.

The complete logic is described after this image.

Now, let us revisit how the credit line in the journal has been built. Typically Code Combination for the credit/liability accounting entry of the invoice line is picked from Payables Options setup of the operating unit. However in this case, in SLA we have hard coded the credit account to be 01.000.2220.0000.000. This was done by defining ANIL_LIABILIY_ADR as shown below. In this case the ADR returns the complete CCID because the Output Type radio button is set to Flexfield.

Hence, the SLA has generated the same Credit entry CCID for the invoice, as shown in image below

Needless to say that the ANIL_LIABILITY_ADR was attached to the Journal Line Type=ANIL_JLT_CREDIT.

No comments:

Post a Comment